April 25, 2024 by Joe Ross

Much of the analysis of the FCC broadband service data focuses on identifying unserved and underserved locations for the Broadband Equity, Access, and Deployment (BEAD) grant program. However, because the data provides details of service from all service providers per location, we can not only understand the level of competitiveness at different service levels, technologies, and other broadband service conditions, but can track changes in service levels over time. Televate developed a software application to conduct comparative analyses of broadband service after performing a similar analysis in Arlington County, Virginia (see Section 3 of this report).

The Federal government is rightly focused on ensuring that every location has at least one high speed service provider; however, the next step is ensuring that every household and business has a choice among high quality service providers. The BEAD program is likely to decrease the level of competitiveness because, by definition, the funded locations have no providers offering 100 Mbps down and 20 Mbps up (with an exception provided below). If there are no providers at a location offering 100/20 Mbps service, and BEAD funds one provider that does, that new provider has no competition at the 100/20 level or higher. To shed light on addressing the post-BEAD challenge, we’ve analyzed the State of Florida’s competition level on a county-by-county basis.

Evaluating Florida Broadband Competition

Televate’s analysis uses the same assumption NTIA has made regarding “reliable” broadband service. Specifically, we are omitting satellite and unlicensed wireless service, as they were determined by NTIA to be considered unreliable. Our analysis was made using the June 2023 dataset, which is the latest available (the December 2023 data should be available in May 2024), and a data version as of April 16, 2024. The analysis factors in the realities of the technologies. Specifically, we break down competition among gigabit solutions, cable and fiber, differentiating them from other technologies that may not meet the needs of some data hungry households and businesses. Some providers may not offer symmetric gigabit service today using these technologies, but they will have a roadmap to deliver such speeds using these media. For example, Quantum Fiber advertises fiber service at speeds of 940 Mbps down and 940 Mbps up, which is virtually gigabit (the line rate is probably gigabit, but with overhead, 60 Mbps less is available to the end user). And cable providers such as Charter and Comcast (the two largest in Florida) offer cable-based service predominately at 1000 Mbps down and 35 Mbps up but intend to roll out DOCSIS 4.0 next year and begin to offer symmetric gigabit service.

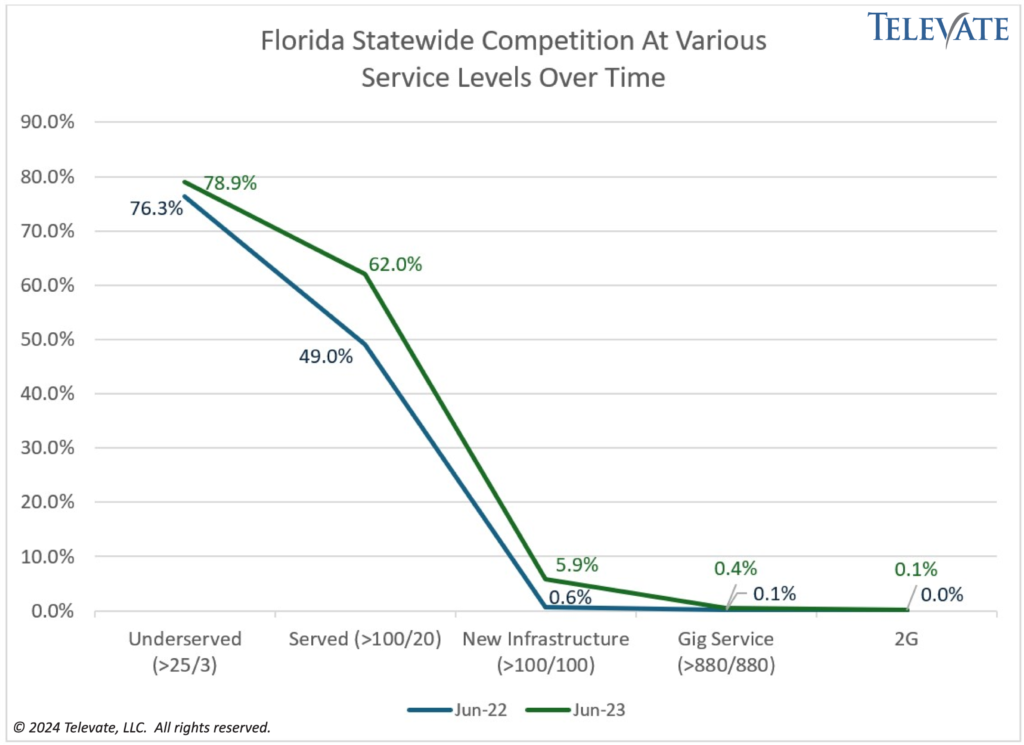

Florida’s story is similar to most states in that much of the cable service has not met the upload speed of 100 Mbps established by the federal government for the new infrastructure deployed by BEAD. Historically, many locations have been served by the one cable franchisee and one legacy telephone provider. In some cases, the telephone provider has upgraded its infrastructure to fiber, and offers speeds nearing or exceeding one gigabit symmetric. Florida’s competition levels over time shed light on service growth statewide. Roughly half a million locations were added using fiber, cable, and wireless technologies between June 2022 and June 2023.

In June 2022, the Florida broadband providers reported fewer than 46,000 competitive locations that provide download and upload speeds of 100 Mbps or more. In June 2023, providers reported over 435,000 locations with symmetric 100+ Mbps service substantially impacted by cable network upgrades. The figure below highlights this trend with a major shift in locations that achieve competitive 100 Mbps download and 100 Mbps upload speeds. In June 2022, less than one percent of Florida locations were competitive at this level, and in the June 2023 FCC data that number has risen to 6 percent. Competition at served levels (100/20 Mbps or better) increased by 13% over this time period. Over 700,000 more locations become competitive at this service level during the year. As cable operators upgrade their service to initially 100 to 200 Mbps upload speeds, and in 2025 to gigabit upload speeds, we expect to see a major shift in the level of competition with these higher speed services.

In addition, Florida is seeing an increase in competition among those providers with the gigabit technologies, cable and fiber. Statewide, just 40 percent of locations had competition among these gigabit technologies in June 2022, and today that has increased to 46 percent. So, while cable’s upgrade path will help achieve these higher levels of competition, the current infrastructure would deliver symmetric (both upload and download) speeds to only half the locations statewide.

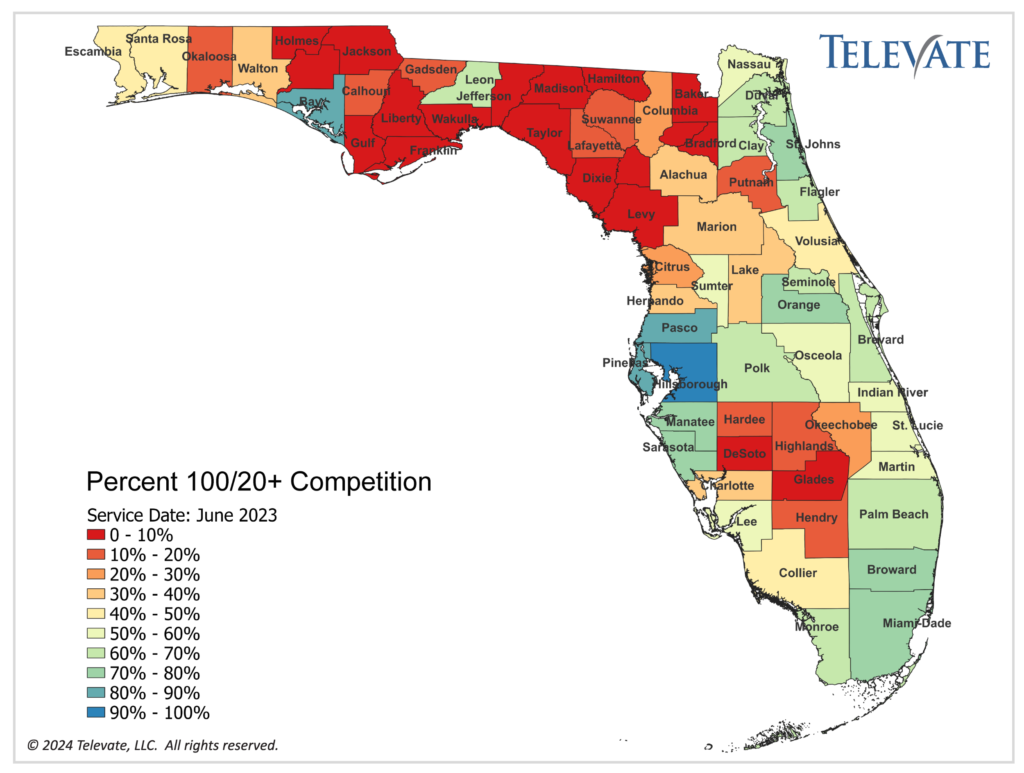

Economics play a major role in whether or not competition exists at any one location. Neighborhoods where businesses or residences are denser and income levels are higher are more likely to see competition because build costs are lower, and revenues are higher for the internet service providers (ISPs). This plays out in terms of high-speed service as well as the levels of competition in Florida. The graphic below shows the percentage of locations per county that are served (using the Federal government’s 100/20 Mbps threshold) and have competition (i.e., the competitive 100/20 locations divided by the total 100/20 locations).

With the exception of Bay County, the top five counties have populations in excess of 1 million. The least competitive counties all have populations less than 25 thousand and are among the least dense counties in the state. Statewide, 62 percent of all served locations—just under two-thirds—have competition.

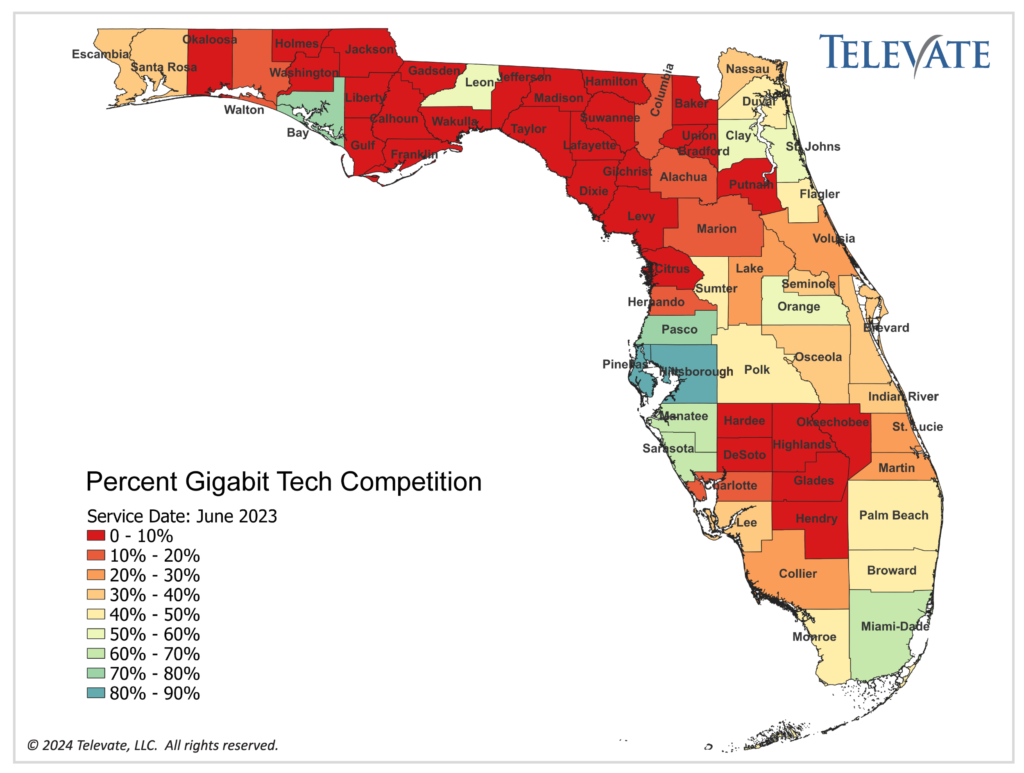

When considering gigabit technology, there is even less competition. The most common configuration of gigabit service is cable service. Statewide, 91 percent of all locations have cable service, while 44 percent have fiber service. In total, 46 percent of all locations have competitive gigabit service (note, some locations have competitive fiber service making up the difference). Six counties—Lafayette, Gilchrist, Glades, Union, Jefferson, and Dixie—have no gigabit competition (at the same location – they might have different providers countywide). The top 10 most competitive gigabit technology counties are among the most populous and dense.

The analysis reveals some major discrepancies between the percentage of locations with “served” versus gigabit technology competition. For example, Miami-Dade has competition at 80 percent of served locations, but only 67 percent of gigabit technology locations have gigabit competition. In Martin County, 57 percent of served locations have competition while only 23 percent of gigabit technology locations have gigabit technology competition.

These counties are predominantly the densest in Florida with the exception of Bay County with a population of 173 thousand and a population density of 167.4 per square mile (which is generally less than half the density of the other top counties). Notably absent in this list are large and very dense counties such as Broward, Seminole, Orange, Duval, Palm Beach, and Lee Counties with 50, 39, 53, 48, 43, and 39 percent gigabit technology competition. It is important to note that these percentages reflect those locations that have any gigabit capable technology. BEAD should convert most of those that do not have gigabit available today to gigabit; however, that approach is unlikely to help solve the gigabit competition levels. In fact, because the unserved and underserved locations likely do not have gigabit technologies, they are likely to create more gigabit technology monopolies after BEAD deployment unless the BEAD grant is leveraged to fund open access solutions with multiple independent providers.

In total, over 2.4 million locations statewide (of more than seven million) that are currently “served” with 100/20 service lack competition from a second provider offering such speeds. Fortunately, most of the locations that are served are served by gigabit cable and fiber technologies. The gap for gigabit competition is even greater with over 4 million locations with gigabit technology lacking competition, most of which are locations where there is a cable provider and no fiber. But Florida is not unique, and this level of competition can be seen nationwide.

Future Opportunities for States

There are opportunities in Florida and across the country for ISPs to build competitive fiber solutions with a strong return on investment. It is important for governments across the country to focus on competition in addition to their underserved and unserved locations and to work with competitive ISPs to serve their residents and businesses. The Televate Broadband Reports can be leveraged to facilitate comprehensive studies to support the decision-making process.